| Content | Guidance, clarification and syllabus links |

|---|---|

|

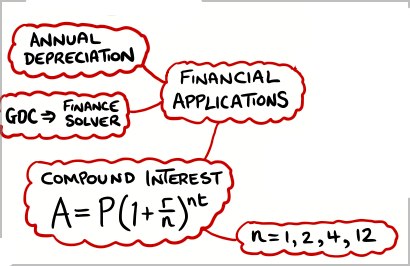

Financial applications of geometric sequences and series: compound interest, annual depreciation. Use of technology, including built-in financial packages. Calculate the real value of an investment with an interest rate and an inflation rate. |

Examination questions may require the use of technology, including built-in financial packages. The concept of simple interest may be used as an introduction to compound interest. Compound interest can be calculated yearly, half-yearly, quarterly or monthly. In examinations, questions that ask students to derive the formula will not be set. Link to exponential models/functions in topic 2. |

📌 Introduction

Financial applications of geometric sequences bridge the gap between mathematical theory and real-world economics. When money grows through compound interest or assets lose value through depreciation, these processes follow geometric patterns where each term relates to the previous by a constant multiplicative factor.

Understanding compound interest is fundamental to personal finance, investment decisions, and economic modeling. Unlike simple interest, where growth is linear, compound interest creates exponential growth as interest earns interest. Similarly, depreciation models help businesses and individuals understand how assets lose value over time, following geometric decay patterns essential for accounting, taxation, and investment planning.

📌 Definition Table

| Term | Definition |

|---|---|

| Simple Interest |

Interest calculated only on the principal amount. Formula: \(A = P(1 + rt)\) Growth is linear – same amount added each period |

| Compound Interest |

Interest calculated on principal plus accumulated interest. Formula: \(FV = PV(1 + \frac{r}{100k})^{kn}\) Growth is exponential – interest earns interest |

| Present Value (PV) |

The initial amount of money invested or borrowed Also called principal amount |

| Future Value (FV) |

The value of an investment after compound interest is applied Total amount = Principal + Interest |

| Interest Rate (r) |

Annual percentage rate at which money grows or is charged Usually given as percentage per annum (p.a.) |

| Compounding Period (k) |

How often interest is calculated and added: Annual (k=1), Semi-annual (k=2), Quarterly (k=4), Monthly (k=12) |

| Depreciation |

The decrease in value of an asset over time Formula: \(FV = PV(1 – \frac{d}{100})^n\) where d is depreciation rate |

| Real Value |

The purchasing power of money accounting for inflation Adjusts nominal values for the effect of inflation |

📌 Properties & Key Formulas

- Compound Interest Formula: \(FV = PV(1 + \frac{r}{100k})^{kn}\) where k = compounding frequency

- Annual Compounding: \(FV = PV(1 + \frac{r}{100})^n\) (k = 1)

- Depreciation Formula: \(FV = PV(1 – \frac{d}{100})^n\) where d = depreciation rate

- Simple Interest Formula: \(A = P(1 + \frac{rt}{100})\) for comparison

- Real Value with Inflation: \(Real = \frac{Nominal}{(1 + \frac{i}{100})^n}\) where i = inflation rate

- Effective Annual Rate: \(EAR = (1 + \frac{r}{100k})^k – 1\)

- Loan Repayment (EMI): \(EMI = \frac{P \times \frac{r}{1200} \times (1+\frac{r}{1200})^n}{(1+\frac{r}{1200})^n-1}\)

Compounding Frequency Values:

- Annual compounding: k = 1 (once per year)

- Semi-annual compounding: k = 2 (twice per year)

- Quarterly compounding: k = 4 (four times per year)

- Monthly compounding: k = 12 (twelve times per year)

- Daily compounding: k = 365 (every day)

Remember: More frequent compounding leads to higher effective returns due to the “compounding effect” – interest earning interest more often throughout the year.

📌 Common Mistakes & How to Avoid Them

Wrong: Using \(A = P(1 + rt)\) for compound interest

Right: Use \(FV = PV(1 + \frac{r}{100})^n\) for annual compounding

How to avoid: Simple interest is linear (same amount added each period), compound interest is exponential (percentage of growing amount).

Wrong: Using annual rate directly for monthly compounding

Right: Divide rate by 12 and multiply time by 12 for monthly compounding

Example: 6% annually, monthly compounding = \(\frac{6}{12} = 0.5\%\) per month

How to avoid: Always adjust both rate and time for the compounding frequency.

Wrong: Using addition instead of subtraction for depreciation

Right: \(FV = PV(1 – \frac{d}{100})^n\) with minus sign

How to avoid: Depreciation decreases value, so use (1 – rate), not (1 + rate).

Wrong: Using loan amount as FV instead of PV

Right: Loan amount borrowed is PV; total amount paid back is FV

How to avoid: PV = Present (now), FV = Future (later). Money borrowed now grows to amount owed later.

Wrong: Comparing nominal values across different time periods

Right: Adjust for inflation: \(Real = \frac{Nominal}{(1 + \frac{inflation}{100})^n}\)

How to avoid: When comparing values across time, always consider purchasing power changes due to inflation.

📌 Calculator Skills: Casio CG-50 & TI-84

TVM Solver (Time Value of Money):

1. Press [MENU] → Select “Financial”

2. Choose “TVM Solver”

3. Enter known values:

• N = number of periods

• I% = annual interest rate

• PV = present value (negative for money paid)

• PMT = payment per period

• FV = future value

4. Position cursor on unknown value, press [SOLVE]

Compound Interest Example:

$5000 invested at 4% annually for 8 years

• N = 8

• I% = 4

• PV = -5000 (money invested)

• PMT = 0

• FV = ? (solve for this)

For monthly compounding:

• N = 8 × 12 = 96 months

• I% = 4 (annual rate)

• P/Y = 12 (payments per year)

• C/Y = 12 (compounding per year)

Apps → Finance → TVM Solver:

1. Press [APPS] → “Finance” → “TVM Solver”

2. Enter values:

• N = total number of payments

• I% = annual interest rate

• PV = present value

• PMT = payment amount

• FV = future value

• P/Y = payments per year

• C/Y = compounding periods per year

3. Move cursor to unknown variable

4. Press [ALPHA] [SOLVE]

Manual calculation using formula:

1. Press [2nd] [QUIT] to exit to home screen

2. Enter formula: 5000*(1+.04)^8

3. Press [ENTER] for result

For different compounding periods:

• Quarterly: 5000*(1+.04/4)^(4*8)

• Monthly: 5000*(1+.04/12)^(12*8)

Sign conventions:

• Money flowing out (invested/paid) = negative

• Money flowing in (received/earned) = positive

• This helps distinguish between loans and investments

Solving for different variables:

• Interest rate: Enter N, PV, FV; solve for I%

• Time: Enter I%, PV, FV; solve for N

• Payment: Enter N, I%, PV, FV; solve for PMT

Verification methods:

• Always check if your answer makes sense

• Compound interest should give higher returns than simple interest

• Depreciation should decrease value over time

• More frequent compounding should give slightly higher returns

📌 Mind Map

📌 Applications in Science and IB Math

- Personal Finance: Savings accounts, retirement planning, mortgage calculations, loan repayments

- Business & Economics: Investment valuation, asset depreciation, present value analysis, inflation modeling

- Banking & Insurance: Interest rate calculations, actuarial calculations, risk assessment, premium calculations

- Accounting: Depreciation schedules, asset valuation, financial reporting, tax calculations

- Environmental Economics: Carbon credit trading, resource depletion models, environmental cost calculations

- Population Studies: Growth rate modeling, demographic projections, resource planning

- Engineering: Equipment depreciation, project cost analysis, lifecycle costing, maintenance planning

- Healthcare: Medical equipment depreciation, pharmaceutical pricing, insurance calculations, treatment cost modeling

Excellent IA Topics:

• Comparing investment strategies: compound vs simple interest over different periods

• Mortgage vs renting analysis with inflation considerations

• Student loan repayment optimization strategies

• Cryptocurrency investment analysis using geometric growth models

• Car depreciation models and optimal selling times

• Retirement savings planning with compound interest

• Credit card debt analysis and payoff strategies

IA Structure Tips:

• Use real financial data from banks, government sources, or personal examples

• Compare different scenarios (frequencies, rates, time periods)

• Include graphical representations of growth/decay curves

• Consider external factors like inflation, taxes, fees

• Use technology extensively for calculations and modeling

• Draw practical conclusions and recommendations

📌 Worked Examples (IB Style)

Q1. Sarah invests $8000 in an account that pays 3.5% per annum, compounded quarterly. Find the value of her investment after 6 years.

Solution:

Step 1: Identify the values

PV = $8000, r = 3.5% per annum, k = 4 (quarterly), n = 6 years

Step 2: Apply the compound interest formula

\(FV = PV(1 + \frac{r}{100k})^{kn}\)

Step 3: Substitute values

\(FV = 8000(1 + \frac{3.5}{100 \times 4})^{4 \times 6}\)

\(FV = 8000(1 + 0.00875)^{24}\)

\(FV = 8000(1.00875)^{24}\)

Step 4: Calculate using calculator

\(FV = 8000 \times 1.2314 = \$9851.23\)

✅ Final answer: $9851.23

Q2. A car worth $25,000 depreciates at 12% per annum. What will be its value after 4 years?

Solution:

Step 1: Identify the values

PV = $25,000, depreciation rate d = 12% per annum, n = 4 years

Step 2: Apply the depreciation formula

\(FV = PV(1 – \frac{d}{100})^n\)

Step 3: Substitute values

\(FV = 25000(1 – \frac{12}{100})^4\)

\(FV = 25000(0.88)^4\)

\(FV = 25000 \times 0.5997\)

Step 4: Calculate

\(FV = \$14,992.50\)

✅ Final answer: $14,992.50

Q3. Compare the final amounts: $5000 invested for 10 years at 4% simple interest vs 4% compound interest (annual).

Solution:

Simple Interest calculation:

\(A = P(1 + \frac{rt}{100})\)

\(A = 5000(1 + \frac{4 \times 10}{100}) = 5000(1 + 0.4) = \$7000\)

Compound Interest calculation:

\(FV = PV(1 + \frac{r}{100})^n\)

\(FV = 5000(1 + \frac{4}{100})^{10} = 5000(1.04)^{10} = 5000 \times 1.4802 = \$7401\)

Difference:

Compound interest advantage = $7401 – $7000 = $401

✅ Final answer: Simple = $7000, Compound = $7401, Difference = $401

Q4. James takes a loan of $20,000 at 6% per annum, compounded monthly. If he repays it in 3 years with equal monthly payments, find his monthly payment (EMI).

Solution:

Step 1: Identify values

P = $20,000, r = 6% per annum, n = 3 years = 36 months

Step 2: Use EMI formula

\(EMI = \frac{P \times \frac{r}{1200} \times (1+\frac{r}{1200})^n}{(1+\frac{r}{1200})^n-1}\)

Step 3: Calculate monthly rate

Monthly rate = \(\frac{6}{1200} = 0.005\)

Step 4: Substitute and calculate

\(EMI = \frac{20000 \times 0.005 \times (1.005)^{36}}{(1.005)^{36}-1}\)

\(EMI = \frac{20000 \times 0.005 \times 1.1967}{1.1967-1} = \frac{119.67}{0.1967} = \$608.44\)

✅ Final answer: Monthly payment = $608.44

Q5. An investment grows from $3000 to $4500 in 5 years with annual compounding. Find the annual interest rate.

Solution:

Step 1: Identify known values

PV = $3000, FV = $4500, n = 5 years, r = ?

Step 2: Use compound interest formula

\(FV = PV(1 + \frac{r}{100})^n\)

\(4500 = 3000(1 + \frac{r}{100})^5\)

Step 3: Solve for r

\((1 + \frac{r}{100})^5 = \frac{4500}{3000} = 1.5\)

\(1 + \frac{r}{100} = (1.5)^{1/5} = 1.0845\)

\(\frac{r}{100} = 0.0845\)

\(r = 8.45\%\)

✅ Final answer: Annual interest rate = 8.45%

Key verification points:

• Compound interest should give higher returns than simple interest

• More frequent compounding should yield slightly higher returns

• Depreciation should decrease value over time

• Interest rates should be positive for investments

• EMI payments should be reasonable relative to loan amount

• Use technology to verify complex calculations

📌 Multiple Choice Questions (with Detailed Solutions)

Q1. $2000 is invested at 5% per annum, compounded annually, for 3 years. What is the final amount?

A) $2315.25 B) $2300.00 C) $2157.63 D) $2200.00

📖 Show Answer

Step-by-step solution:

1. Use compound interest formula: \(FV = PV(1 + \frac{r}{100})^n\)

2. Substitute: \(FV = 2000(1 + \frac{5}{100})^3\)

3. Calculate: \(FV = 2000(1.05)^3 = 2000 \times 1.157625 = \$2315.25\)

✅ Answer: A) $2315.25

Q2. A computer worth $1200 depreciates at 15% per annum. What is its value after 2 years?

A) $867.00 B) $840.00 C) $900.00 D) $1020.00

📖 Show Answer

Step-by-step solution:

1. Use depreciation formula: \(FV = PV(1 – \frac{d}{100})^n\)

2. Substitute: \(FV = 1200(1 – \frac{15}{100})^2\)

3. Calculate: \(FV = 1200(0.85)^2 = 1200 \times 0.7225 = \$867.00\)

✅ Answer: A) $867.00

Q3. What is the effective annual rate for 8% compounded quarterly?

A) 8.00% B) 8.24% C) 8.16% D) 8.32%

📖 Show Answer

Step-by-step solution:

1. Use EAR formula: \(EAR = (1 + \frac{r}{100k})^k – 1\)

2. For quarterly: k = 4, r = 8%

3. Calculate: \(EAR = (1 + \frac{8}{400})^4 – 1 = (1.02)^4 – 1 = 0.0824 = 8.24\%\)

✅ Answer: B) 8.24%

📌 Short Answer Questions (with Detailed Solutions)

Q1. Maria invests $4000 at 6% per annum, compounded semi-annually. Calculate the value after 4 years.

📖 Show Answer

Complete solution:

Given: PV = $4000, r = 6% p.a., k = 2 (semi-annually), n = 4 years

Formula: \(FV = PV(1 + \frac{r}{100k})^{kn}\)

Substitute: \(FV = 4000(1 + \frac{6}{200})^{8}\)

\(FV = 4000(1.03)^8 = 4000 \times 1.2668 = \$5067.12\)

✅ Answer: $5067.12

Q2. A machinery worth $80,000 depreciates at 8% annually. After how many complete years will its value first fall below $50,000?

📖 Show Answer

Complete solution:

Given: PV = $80,000, d = 8% p.a., FV < $50,000

Formula: \(FV = PV(1 – \frac{d}{100})^n\)

Set up inequality: \(80000(0.92)^n < 50000\)

\((0.92)^n < 0.625\)

Taking logarithms: \(n > \frac{\ln(0.625)}{\ln(0.92)} = \frac{-0.470}{-0.083} = 5.66\)

Therefore n = 6 complete years

✅ Answer: 6 years

📌 Extended Response Questions (with Full Solutions)

Q1. David wants to buy a house and is comparing two loan options:

Option A: $300,000 at 4.5% per annum, compounded monthly, for 25 years

Option B: $300,000 at 4.8% per annum, compounded quarterly, for 20 years

(a) Calculate the monthly payment for Option A. [4 marks]

(b) Calculate the quarterly payment for Option B. [4 marks]

(c) Calculate the total amount paid over the life of each loan. [3 marks]

(d) Which option would you recommend and why? Consider both monthly burden and total cost. [4 marks]

📖 Show Answer

Complete solution:

(a) Monthly payment for Option A:

Given: P = $300,000, r = 4.5% p.a., n = 25 × 12 = 300 months

Monthly rate = 4.5/1200 = 0.00375

EMI = \(\frac{300000 \times 0.00375 \times (1.00375)^{300}}{(1.00375)^{300}-1}\)

EMI = \(\frac{1125 \times 3.054}{2.054} = \$1669.39\)

(b) Quarterly payment for Option B:

Given: P = $300,000, r = 4.8% p.a., n = 20 × 4 = 80 quarters

Quarterly rate = 4.8/400 = 0.012

Quarterly EMI = \(\frac{300000 \times 0.012 \times (1.012)^{80}}{(1.012)^{80}-1}\)

Quarterly EMI = \(\frac{3600 \times 2.566}{1.566} = \$5896.93\)

(c) Total amount paid:

Option A: $1669.39 × 300 = $500,817

Option B: $5896.93 × 80 = $471,754

(d) Recommendation:

• Option A: Lower monthly payment ($1669.39) but higher total cost ($500,817)

• Option B: Higher quarterly burden ($5896.93 ≈ $1965.64/month) but lower total cost ($471,754)

• Savings with Option B: $29,063

Recommendation: Choose Option B if monthly cash flow allows, as it saves $29,063 over the loan life despite higher monthly payments.

✅ Final Answers:

(a) Monthly payment A: $1669.39

(b) Quarterly payment B: $5896.93

(c) Total A: $500,817, Total B: $471,754

(d) Recommend Option B for lower total cost