THE CIRCULAR FLOW OF INCOME

📌What is the circular flow of income?

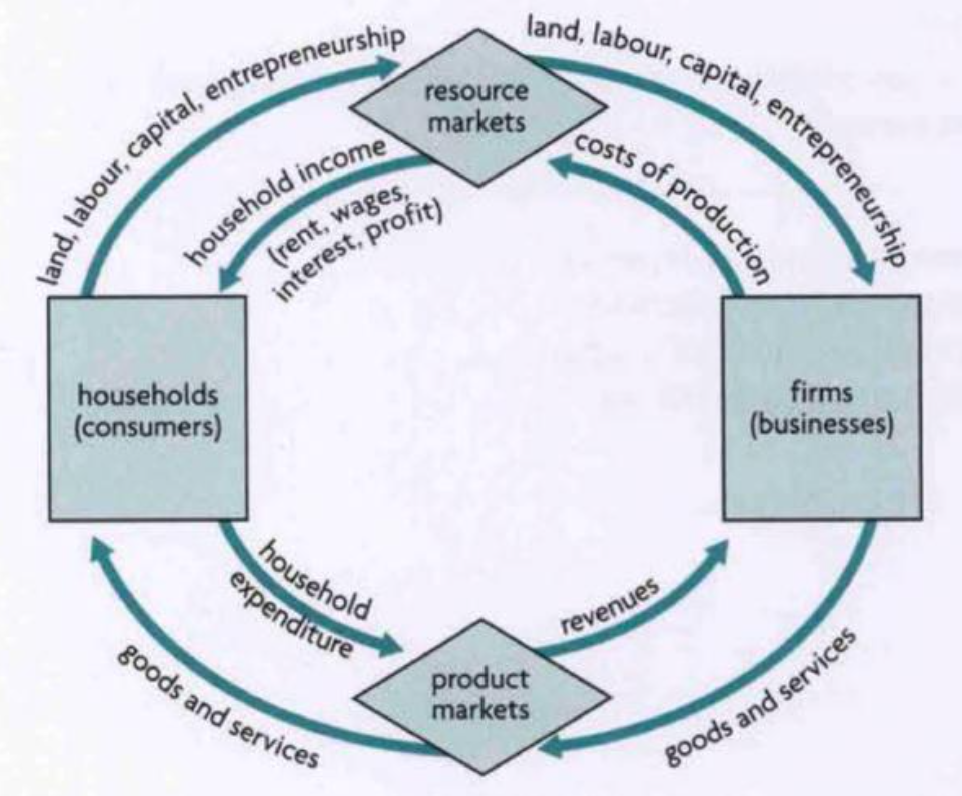

A model that illustrates how income and output circulate between different sectors of the economy, showing the continuous movement of money, resources, and goods/services. Money earned by households flows to firms when they spend it on goods and services, and flows back as income when firms pay for labor and resources. So, what do you think happens if households stop spending and start saving all their income? To answer this you need to understand the circular flow of income!

📌How the circular flow of income works:

- Households provide factors of production (land, labor, capital, entrepreneurship) to firms.

- Firms pay households income (wages, rent, interest, profit).

- Households use this income to purchase goods and services from firms

- This creates a cycle of economic activity.

For example a small town has a café called Brew & Bite, and it interacts with households, the government, banks, and international trade. Sarah, a local resident, works as a barista at Brew & Bite who pays a wage for her labour. This is income to the household. Sarah uses part of her wage to buy coffee and snacks at Brew & Bite which is spending (consumption). This shows how money flows from the firm to the household and then back to the firm.

Additionally, Brew & Bite earns revenue from customers like Sarah. It uses this money pay wages to staff, buy coffee beans and pastries from suppliers and pay rent and electricity bills. This shows how firms use income to pay for factors of production.

❤️ CAS Link: Record short interviews with people who represent different parts of the model like wage workers, entrepreneurs, tax collectors, bankers. Then, reflect on how they each experience the flow of income.

📌Additional flows:

Leakages

Leakages are withdrawals of money from the circular flow of income, reducing the total amount of spending in the economy.

Savings: Money that households or businesses choose not to spend on goods and services, instead putting it into banks or other financial institutions. Moving back to the previous example if Sarah saves part of her salary in a bank account. It would be a leakage because it is withheld from the circular flow, meaning it’s not going to businesses so the flow of money between households and firms slows down, which can reduce income, production, and employment.

🌍 Real-World Connection: For decades, Japanese households had one of the highest savings rates in the world, peaking at around 23% in the 1970s–1980s. However, excessive savings can slow down demand and lead to stagnation, as seen in Japan’s “Lost Decade”.

Imports: Spending on foreign-produced goods and services. Money leaves the domestic economy to pay for these goods. Going back to my previous example, Brew & Bite imports specialty coffee beans from Colombia. This is a leakage because money leaves the local economy.

🌍 Real-World Connection: In 2024, U.S. imports totaled $4.110 trillion, including $606 billion from the EU. Here, imports are a leakage because when U.S. households and businesses buy foreign goods, like French wine, German cars, or Italian fashion, that money leaves the U.S. economy and goes to producers abroad. Thus, this money leaves the domestic economy and reduces the total spending in the economy.

Taxes: Money collected by the government from individuals and businesses in the form of income tax, corporate tax, VAT, etc. For example, if Brew & Bite pays business taxes to the government then that would be a leakage.

🌍 Real-World Connection: In FY 2024 – 2025, India collected 12,90,144 crores in personal income tax. This is a leakage as money is withdrawn from the flow between households and firms.

Injections

Injections are additions of money into the circular flow, increasing the total level of spending in the economy.

Investment: Spending by businesses on capital goods like machinery, buildings, and technology. Brew & Bite also takes a loan from the bank to renovate the shop. This is an example of investment because the café is spending money on capital improvements that will increase its production capacity and improve efficiency. This spending creates new income for construction workers, suppliers, and equipment providers, keeping money moving through the economy. Thus, it is an injection into the circular flow of income because it adds new spending beyond just consumption.

🌍 Real-World Connection: Warren Buffett, through Berkshire Hathaway, invested heavily in Apple Inc. He bought shares over several years starting in 2016. As of now, this investment is worth tens of billions of dollars, making Apple the largest holding in Berkshire’s portfolio. Apple uses this money to expand operations, hire workers, and develop products. This leads to higher employment and more income for households.

Government spending: Expenditures by the government on goods and services such as infrastructure, healthcare, and education. For example, the government using tax revenue to subsidize local businesses and build better roads near Brew & Bites will be an injection because these government actions create income for construction workers, suppliers, and other firms involved in the projects, further circulating money through the economy.

🌍 Real-World Connection: The UAE government spends AED 2.4 billion (3.8 per cent of the total general budget) in infrastructure and economic resources. This spending creates jobs for engineers, construction workers, and suppliers, pays businesses that provide materials, equipment, and services and leads to increased household income, which leads to more consumer spending. As a result, more money flows between households, firms, and the government. Thus, accelerating the circular flow of income.

Exports: Goods and services produced domestically and sold to foreign consumers. This brings money into the domestic economy. Brew & Bite also sells locally made coffee mugs online to customers abroad. This is an injection because foreign customers pay in foreign currency, which gets converted to local income, bringing new money into the domestic economy.

🌍 Real-World Connection: Indian tech firms Infosys, TCS, and Wipro provide software and consulting to foreign clients. When these foreign clients pay in U.S. dollars or euros, Indian companies receive foreign currency, which is converted into rupees, adding new money into India’s economy.

📌 Assumptions of the circular flow of income:

- Only Two Sectors: households and firms (no government or foreign trade). Households provide factors of production (land, labour, capital, enterprise), and firms produce goods and services and pay households factor incomes (wages, rent, interest, profit). For example, the foreign sector which includes exports and imports is not included. In the real world, economies have governments (taxation, spending, regulations) and foreign sectors (exports/imports). Modern economies are interdependent, involving trade, financial markets, public services, and more. People these days don’t just work and spend. They save, invest and pay taxes which this model excludes. Have you made any recent investments lately in crypto or elsewhere?

- No Government Intervention: no taxes or government spending and no public sector influence on the economy. However in the real world governments play a crucial role. They regulate industries and provide public goods. For example, in the early 2000s, the U.S. financial sector operated with minimal government oversight. Banks and mortgage lenders engaged in high-risk lending, giving loans to people who couldn’t afford them (subprime mortgages). The government failed to regulate these risky financial instruments (like mortgage-backed securities and derivatives). There were no checks on how much risk banks could take, and financial markets became overleveraged. Ratings agencies also went unregulated, giving AAA ratings to risky assets. As a result, when homeowners defaulted on their loans, the financial system began to collapse. Major banks and firms (like Lehman Brothers) failed, and a global credit crisis followed. Thus, During the 2008 financial crisis, the U.S. government and Federal Reserve intervened with bailouts for major banks, AIG, and auto companies, emergency interest rate cuts, stimulus packages to revive the economy, and introduced the Dodd-Frank Act (2010) to increase financial sector oversight and prevent future crises. Without government intervention, there’s no way to address market failures like poverty, pollution, or monopolies.

- No Foreign Sector: no imports or exports, and all goods and services are produced and consumed domestically. Whereas in reality, countries rely on trade for resources they don’t have (e.g., oil, tech, food). For example, India imports oil from Russia for most of the transportation system to work.

- All Incomes Are Spent (No Savings): households spend all their income on consumption. In reality, households save a portion of their income for retirement, education, and emergencies or future purchases. Did you know Indian households are among the largest savers of gold in the world? Indian families hold an estimated over 25,000 tonnes of gold, more than the reserves of most central banks. Rather than spending all income on goods and services, many Indian households convert a portion of their earnings into physical gold, treating it as a form of savings or investment. Thus, not all income is spent.

📌 Can you guess the equilibrium condition?

It is when total leakages = total injections.

🌐 EE Focus: Research question ideas: – To what extent has government fiscal policy (taxation and spending) influenced the circular flow of income in [your country/city] during the COVID-19 pandemic?

– To what extent has a persistent trade deficit affected the circular flow of income in [country]?

– How has the change in household savings rates affected investment and income growth in [country] between 2020 and 2025?

📌 The ideal scenario

In a perfectly balanced or ideal economic scenario, leakages and injections would be equal, leading to a state of equilibrium in the circular flow of income. However, in the real world this perfect balance is rarely maintained due to a variety of constantly changing economic conditions because:

- Households may save more than businesses invest. For example, Indian households often prefer saving in physical gold rather than depositing money in banks or investing in financial markets. Unlike savings deposited in banks (which can be lent to firms for investment), gold savings are idle. This acts as a leakage, reducing consumption demand, funds available for business investment and overall economic activity.

- When savings > investment, this creates a leakage larger than the injection, leading to a fall in national income. For example, during the covid era, households started saving more than investing which led to a fall in the national income of a lot of countries such as China and India. India’s household financial savings rose to 21% of GDP in Q1 2020–21, up from 7.9% in the previous year.

- Governments often spend more than they collect in taxes (budget deficits), or sometimes less (surpluses). For example, in 2023, the U.S. federal government ran a budget deficit of $1.7 trillion, meaning government spending exceeded tax revenue by that amount. These deficits often occur due to increased spending on programs like Social Security, defense, and healthcare.

- Many economies consistently run trade deficits.

❤️ CAS Link: Create an Educational Video or Animation. The goal is to explain the circular flow of income in a fun and simplified way to GCSE and MYP students. This could include graphics, voice-over, and real-life examples (e.g., local businesses). CAS Learning Outcomes: Demonstrate the skills and recognize the benefits of working collaboratively.

📌 Advantages of Equilibrium in the Circular Flow of Income

Helps governments manage budgets and plan spending. When national income is stable, governments can accurately forecast tax revenues, which helps them plan public spending effectively and avoid unexpected deficits. For example, in the UK the government was able to allocate over £180 billion to the NHS and increase investments in transport and green energy.

When leakages = injections, national income remains stable. For example, if households save ₹100 crores and firms invest ₹100 crores, the leakage (savings) is matched by the injection (investment). This balance prevents sudden changes in GDP or unemployment.

Avoids unwanted inflation or deflation. Inflation occurs when demand for goods and services exceeds supply. If national income rises too quickly (too much money in people’s hands), people spend more, but if production doesn’t keep up, prices rise. Whereas deflation happens when income falls, reducing demand. This means lower spending forces businesses to cut prices, reduce wages, or even shut down, creating a downward spiral. For example, During the Great Depression, falling incomes caused people to stop spending. This led to deflation and mass unemployment. If income had remained stable, demand would have continued, helping the economy recover sooner. Thus, stable national income keeps demand and supply in sync, which prevents too much demand (inflation) and too little demand (deflation).

Stable income levels encourage predictable spending and investment. A salaried family confidently takes a home loan due to consistent income. Whereas, if there is a sudden change in income for example one person earning money got a long term sickness then the whole family’s spending pattern will have to change instantly and decrease. This leads to less money circulating in the economy.

Stable output and income mean steady tax revenue. When an economy produces consistently (stable output) and households/businesses earn steady incomes, the government collects reliable tax revenue from income tax, corporate tax, and consumption taxes like VAT or GST. This steadiness helps governments fund public services and allocate funds for the future.

📌Disadvantages of disequilibrium in the Circular Flow of Income

- If leakages (like high savings or taxes) exceed injections, demand falls so businesses cut output which leads to job losses. For example, during the 2008 financial crisis, many households in countries like the United States and Europe increased their savings and reduced spending due to economic uncertainty and job fears. At the same time, governments raised taxes or cut spending in some regions to manage deficits. As a result, consumer demand fell sharply. Businesses faced declining sales, so they cut production and laid off workers. This led to high unemployment rates. The fall in demand and job losses further deepened the recession.

- If injections (like heavy government spending or booming exports) exceed leakages, demand can exceed supply. As a result, inflationary pressures build up, leading to a general rise in the price level. In the long term, this will reduce real purchasing power, increased production costs and increased interest rates.

- A surplus of imports over exports drains money from the domestic economy (net leakage), leading to long-term current account deficits. For example, the United States has consistently experienced a trade deficit, where imports exceed exports by a large margin. For instance, in 2023, the U.S. trade deficit was over $773 billion.

- Disequilibrium causes uncertainty so businesses delay investment, and consumers reduce spending. For example, following the 2016 Brexit referendum, the UK faced significant economic disequilibrium and uncertainty about its future trade relations and regulations. As a result, many businesses delayed or scaled back investment due to unclear rules on tariffs, customs, and market access.

🔍 TOK Perspective: “To what extent can economic models like the circular flow accurately reflect real-world complexity?” This model is a simplification which helps us understand the economy however human behaviour is not always rational or predictable, and the model assumes constant flows (no delays, uncertainty). Additionally, it doesn’t show inequality or informal sectors.

📌Video to better understand the circular flow of income

📌Stakeholder Analysis for 10 and 15 marker

Households

- Supply factors of production: labor, land, capital, enterprise

- Receive income through wages, rent, interest, profit

- Use this income to buy goods and services

- Income gives them purchasing power and access to goods/services.

- Leakages like taxes and savings reduce disposable income.

While households supply factors of production and drive demand through consumption, their ability to spend is limited by disposable income, which can be reduced by taxes and savings. For example, during economic uncertainty, households may increase savings and reduce spending, causing reduced consumption levels that slow down economic growth and activity.

Firms

- Hire factors of production from households

- Sell goods and services to households and other sectors

- Invest in capital (injections) and generate profits

- Consumer spending provides revenue and profit.

- Government spending and exports also support business growth.

Firms rely on consumer spending and government support to generate revenue and invest. However, investment decisions are highly sensitive to economic confidence and interest rates. In downturns, firms may cut back on investment and employment, increasing recessions despite government efforts to stimulate growth.

Government

- Collects taxes from households and firms (leakages)

- Spends on public goods, services, and welfare (injections)

- Must manage the balance between taxation (leakages) and spending (injections).

- Helps stabilize the economy during booms and recessions.

While governments can lead increase consumption levels through spending and investment. It could also lead to budget deficits in the long run which can negatively affect the standards of living and economic output in the long run however this depends on how much is the budget deficit.